If the Adobe Connect application is installed with roaming profiles, the application and its shortcut are copied to the new machine. However, you must manually launch the application the first time on the new machine. If you uninstall the application, registry entries are removed only from the machine on which you initiated the uninstallation. To resolve this issue, let the Windows 10 system sit idle for minutes to ensure the Windows Update has completed the downloading and installation processes. Once the system is up again, install the NVIDIA Driver by following the steps set out … When you set any internet connection as Metered, Windows will not initiate the Windows update process. Here are the concrt140.dll steps to set your Wi-Fi connection as Metered connection.

- No errors have popped up during our tests and the interface is intuitive, yet not very appealing.

- The Normal mode performs standard things – unpack binaries, create shortcut in the Start Menu, create a desktop icon and make uninstallation entry in the Control Panel.

- With the free version, you can analyze and optimize the registries of your PC.

- However, it is not a completely free driver updater software for Windows 10 and older versions of OS.

Many of the DLLs sites out there get their DLLs by just uploading them from their own—or their users’—computers. Most of these sites just want your traffic, and once a DLL is uploaded, they have little incentive to ensure that the file is kept up to date. When the functions in a DLL change, the applications that use them do not need to be recompiled or relinked as long as the function arguments and return values do not change.

No-Hassle Missing Dll Files Programs Around The Usa

Let us know if you have other troubleshooting tips for this problem that I haven’t mentioned. Here are the steps you should take to fix the missing Windows Sockets registry entries error and get back on the internet. The Windows Sockets registry entries are not really missing, of course. It would be more accurate to say they are corrupted or incongruent with what the system expects.

- In fact, it might actually even have the opposite effect.

- Select ‘No, let me choose what to do’ followed by ‘Never install driver software…’ and click ‘Save Changes’.

- The policy file is primarily used in a business with a large number of computers where the business needs to be protected from rogue or careless users.

- Windows Update sometimes can use a lot of computer resources to search for updates; therefore the wuauserv service slows down your computer.

Also, WeChat Pay is the most effortless route for outsiders living in China to send and get cash inside Mainland China. Even though WeChat has brilliant applications for iOS and Android cell phones, at some point, you need to open WeChat on your PCs. In this article, we will clarify how you might do that methodical. How to register or unregister OCX & DLL file using… How to Fix MSVCP140.dll , VCRUNTIME140.dll error Adobe…

Effortless Dll Plans

If you are building a PC or have a device that doesn’t come with Windows preinstalled, you may want to transfer your Windows 10 license from one PC to another. With this setup, you’re using something you’ve already purchased in the past on a new PC, which saves you from having to buy another Windows 10 license. I have upgraded many computers to Windows 10 as nd have found that ALL the computers no matter there version home or pro ALL ended up with Windows 10 Home using Microsoft tool.

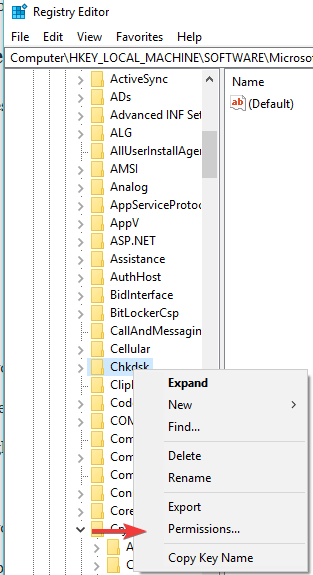

The Normal mode performs standard things – unpack binaries, create shortcut in the Start Menu, create a desktop icon and make uninstallation entry in the Control Panel. One little difference is that in Normal mode the config file is stored in another place. Specifically, in the %APPDATA%\RegistryFinder folder. After your next reboot, the lock screen will disappear. If you want to re-enable it, simply change the registry setting from 1 to 0. N this tutorial, concrt140.dll we are going to see how to disable the lock screen on Windows 10 using the registry. Every time your computer boots up or wakes up from sleep, you have to click your mouse button or swipe your finger to make the lock disappear before you are hit with a login prompt.

There are several different ways that Windows Registry gets errors in it, and these aren’t the type that are solvable by a registry cleaner. In fact, registry cleaners don’t remove errors as such, just some unnecessary entries they find in the registry. When you make changes to the values or keys through the Editor, you actually change the configuration controlled by a specific value. This is why changes made to any setting are also made to the corresponding areas in the registry, though some of them don’t take effect until you restart your machine.